For Immediate Release – Boca Raton, FL – March 9, 2025

Los Angeles is the largest county in the U.S. by population, and yet it might be losing its status as a core institutional market for apartment investment – an implausible scenario 5+ years ago. Need proof? Investors are voting with their wallets: L.A.’s share of total U.S. apartment sales AND new supply has eroded well below pre-COVID levels.

What’s going on? For decades, investors and developers banked on high barriers to entry and structural undersupply. That story is still there. But now those tailwinds are increasingly offset by

predictably unpredictable regulatory landmines.

In recent years, L.A. – city and county – has passed a wave of policies disincentivizing apartment development and investment. This includes a COVID-era eviction ban lasting three years (resulting in one of the nation’s lowest rent collections rates and allegations of rampant fraud — issues owners are STILL working through 2 years later) and a transfer tax adding 5.5% on apartment sales. The icing on the cake is another county-wide eviction ban passed last week. This one specifically targets renters impacted by wildfires, but allows renters to self-certify financial hardship and puts the burden on housing providers to absorb the costs and combat fraud.

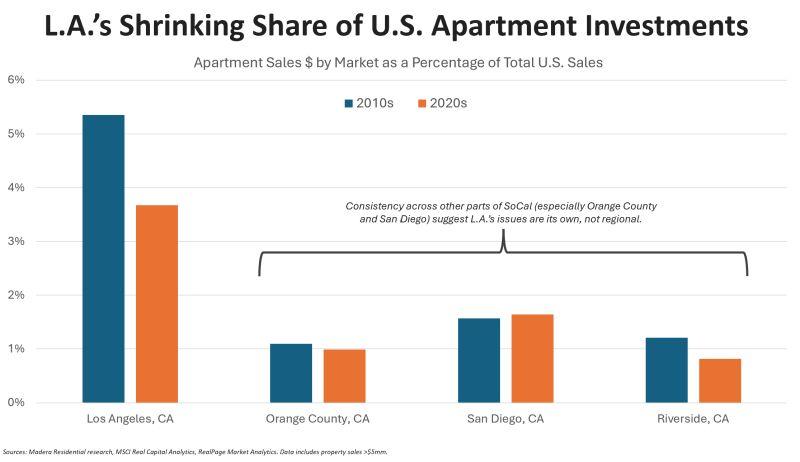

The result: Capital is going elsewhere. In the 2010s decade, Los Angeles County took in 5.4% of all U.S. apartment sales (in terms of dollars). In the 2020s so far, it’s just 3.7%, according to an analysis of data from MSCI Real Capital Analytics. By comparison, there’s no drop occurring in nearby Orange County or San Diego. It’s not a SoCal issue. It’s an L.A. issue.

It’s a similar trend in apartment construction. In 2024, L.A. claimed just 1.1% of newly built units nationally, according to an analysis of RealPage data. That’s the lowest share on record going back 25+ years and well below the preceding 10-year average of 2.5%.

At NMHC this year, one panelist quipped that L.A. would be an institutional market only “until I sell everything we have there, and then it’s not.”

There’s video going around social media of a well-established local operator saying at a different event: “Capital providers are looking at L.A. and saying, ‘Why the [expletive] would we invest there?'”

On my podcast recently, Camden CEO Ric Campo told me that during the eviction moratoria, the region represented 50% of their bad debt (unpaid rent) yet only 10% of the portfolio in terms of revenue. He said it’d take “a lot” to invest in L.A. again.

Equity Residential CEO Mark Parrell said on his Q4’24 earnings call that L.A.’s recent actions “further the reputation L.A. has as being anti-business, anti-housing, and it pushes capital away.”

There’s still a lot to like about L.A. Smaller investors might still do well there operating with thick skin and a very long-term view. But for institutional capital, as Campo pointed out, it’d take “a lot” to win back capital providers’ trust … and dollars.